Which Cost Formula Results In The Higher Cost Of Goods Sold

Which method results in a higher cost of goods sold. Cost of goods sold for the period 100000 200000 100000 200000.

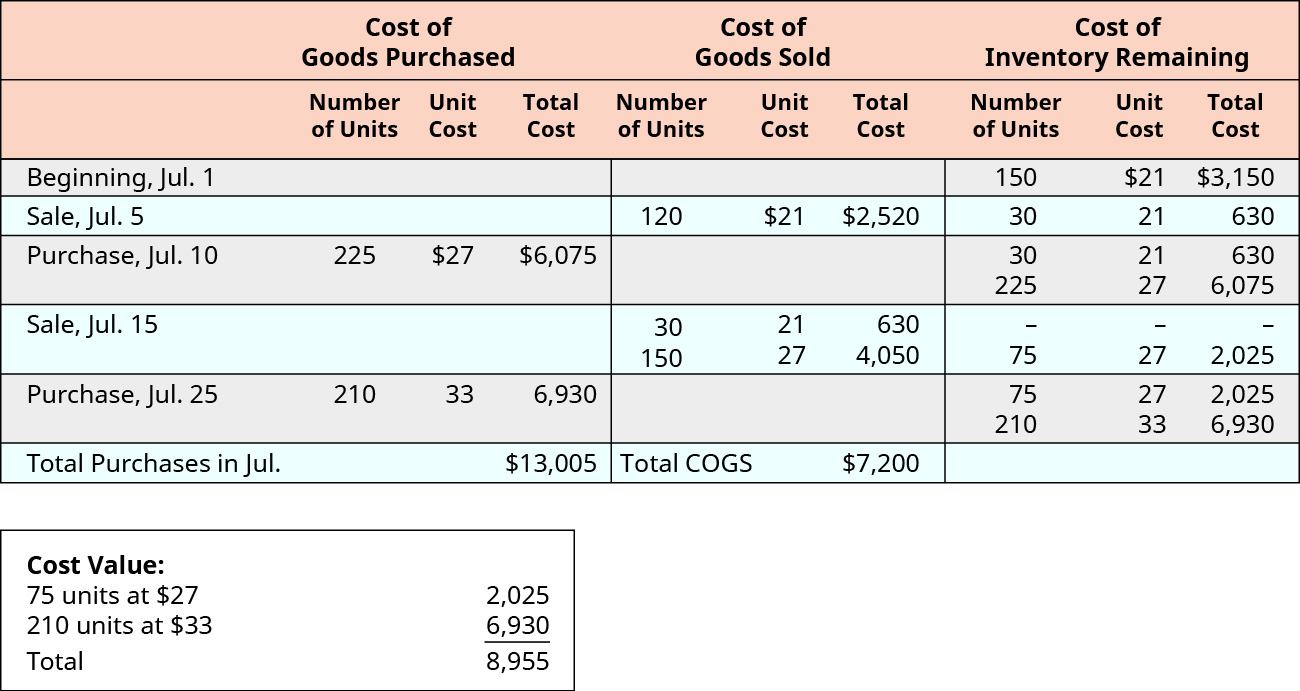

Calculate The Cost Of Goods Sold And Ending Inventory Using The Perpetual Method Principles Of Accounting Volume 1 Financial Accounting

Using LIFO can result in the IRS making adjustments to your taxable income.

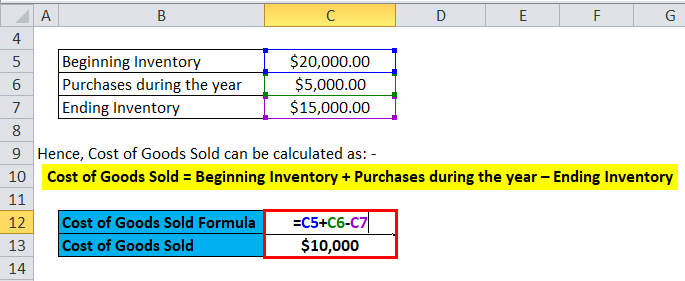

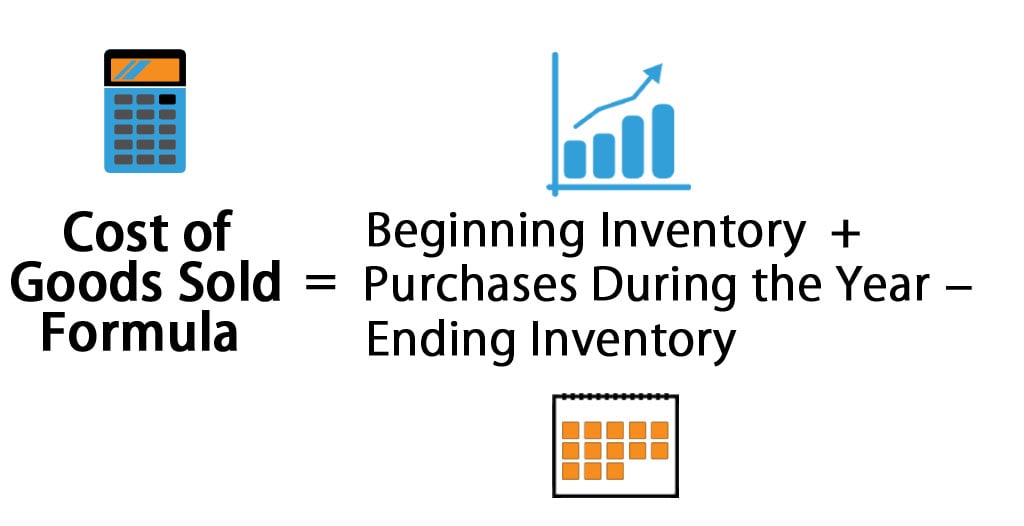

Which cost formula results in the higher cost of goods sold. Pages 39 This preview shows page 33 - 38 out of 39 pages. Cost of Goods Sold Calculation with the Periodic Inventory System An alternative way to calculate the cost of goods sold is to use the periodic inventory system which uses the following formula. B your answer is correct which cost formula results.

Who are the experts. Weighted average cost formula results in the higher cost of goods sold. If your business is US-based youll need to fill out IRS Form 970 before switching to LIFO you cant use LIFO in Canada or any other IFRS country.

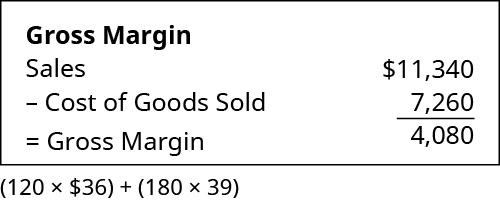

Cost of Goods Sold COGS is the total. Cost of goods sold is deducted from revenue to determine a companys gross profit. School Danang College of Technology.

Which inventory costing method results in a higher Cost of Goods Sold to be reported on the Income Statement when inventory costs are. Which cost formula results in the higher cost of goods sold. Cost of goods sold is an important figure for investors to consider because it has a direct impact on profits.

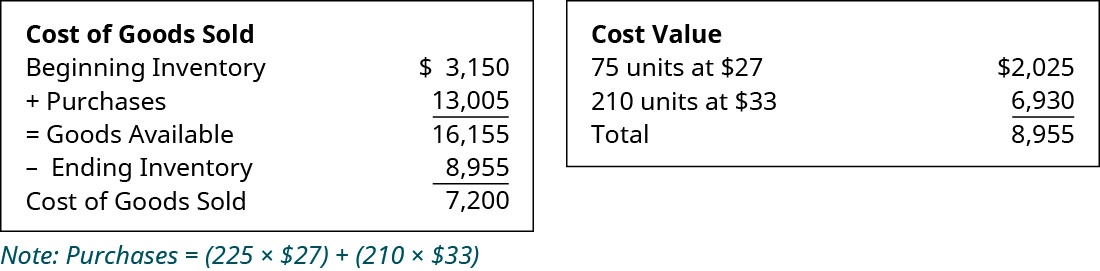

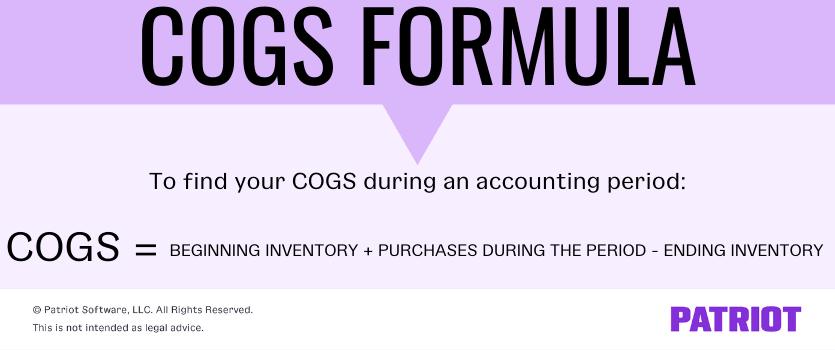

Course Title AC MISC. Gross profit 30000 Sales 200000 100000. Beginning inventory Purchases - Ending inventory Cost of goods sold Thus if a company has beginning inventory of 1000000 purchases during the period of 1800000 and ending inventory of.

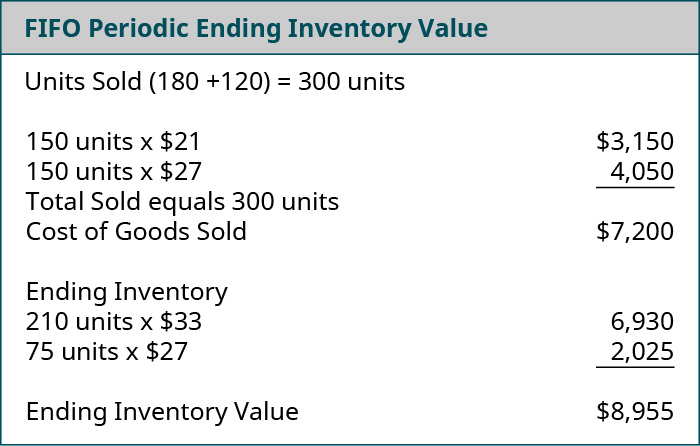

Instructions a Compute the cost of the ending inventory and the cost of goods sold under 1 FIFO and. We review their content and use your feedback to keep the quality high. Gross profit in turn is a measure of how efficient a company is at managing its operations.

Weighted average cost formula results in the higher cost of goods sold. Thus if the cost of goods sold is too high profits. However this gross profit might be the effect of the entity uses different inventories.

ACM values inventory using an average cost for the period. COGS Initial inventory End inventory Purchases For example a company reports an initial inventory of Rp100 a year and purchases of Rp20. It blends costs from throughout the period and smooths out price fluctuations.

Experts are tested by Chegg as specialists in their subject area. Show transcribed image text Expert Answer. Heres the general formula for calculating cost of goods sold.

Or if it is presented in a mathematical equation the formula for the cost of goods sold is as follows. Gross profit margin is 3333 100000300000100 Cost of goods sold analysis. Because costs assigned will be higher and income will be lower which gives you a bigger break on your taxes.

Which method results in a higher cost. -compute cost of goods sold by subtracting ending inventory from goods available for sale-take a physical count of inventory. From the result we can see that the toy companys direct cost of sold goods for the year 2019 is 1450000.

COGS 500 000 1 500 000 - 550 000 1 450 000 COGS 5000001500000550000 1450000 In this case the cost of goods sold would be 1450000. B Your answer is correct Which formula will result in the higher cost of goods from ACC 414 at Ryerson University. Total costs to create products are divided by total units created over the entire period.

As we can see the cost of goods sold is 200000 leading to a gross profit of 100000. See the answer See the answer See the answer done loading. COGS Beginning Inventory Purchases During the Period Ending Inventory COGS 15000 7000 4000.

Find your total COGS for the quarter using the cost of goods sold calculation. In this case LIFO would cause COGS to be higher. B Your answer is correct Which cost formula results in the higher cost of goods.

This problem has been solved. Now lets use our formula and apply the values to our variables to calculate the cost of goods sold.

Calculate The Cost Of Goods Sold And Ending Inventory Using The Periodic Method Principles Of Accounting Volume 1 Financial Accounting

Cost Of Goods Sold Cogs Definition Formula More

Inventory Formula Inventory Calculator Excel Template

Cost Of Goods Sold Cogs Definition

Periodic Lifo Fifo Average Accountingcoach

Cost Of Goods Sold Formula Calculator Excel Template

/TeslaQ2-19IncomeStatementInvestopedia-1466e66b056d48e6b1340bd5cae64602.jpg)

Does Gross Profit Include Labor And Overhead

Cost Of Goods Sold How To Calculate It And What Goes Into Cogs

Sales Cost Of Goods Sold And Gross Profit

Cost Of Goods Sold Formula Calculator Excel Template

Last In First Out Lifo Inventory Calculations Accounting In Focus

Sales Cost Of Goods Sold And Gross Profit

Calculate The Cost Of Goods Sold And Ending Inventory Using The Periodic Method Principles Of Accounting Volume 1 Financial Accounting

Sales Cost Of Goods Sold And Gross Profit

Cost Of Goods Sold Cogs Meaning With Examples

Calculate The Cost Of Goods Sold And Ending Inventory Using The Periodic Method Principles Of Accounting Volume 1 Financial Accounting

What Is Cost Of Goods Sold Definition Formula More Mageplaza

Last In First Out Lifo Inventory Calculations Accounting In Focus

Post a Comment for "Which Cost Formula Results In The Higher Cost Of Goods Sold"