Can An Employer Delay Overtime Pay

Another way that employers may attempt to cheat an employee out of overtime is by misclassifying the employee. The employees must still be paid overtime regardless of the contract.

What Is Predictable Scheduling Small Business Owner Business Owner Small Business

The overtime requirement may not be waived by agreement between the employer and employees.

Can an employer delay overtime pay. Do employers have to pay overtime. Where there is a written express contractual right to do so. Since an employee entered into an agreement to exchange labor for fixed compensation the employer does not have the right to dock her pay.

While the term prompt doesnt set a specific timeline what it means is that employers must pay their employees on the next payday after a pay period ends and they must pay employees for all the hours theyve worked including any overtime. As an employee you have a federal right to receive overtime pay for any hours worked over a standard 40 hour workweek. It depends on the terms and conditions detailed in the employment contract.

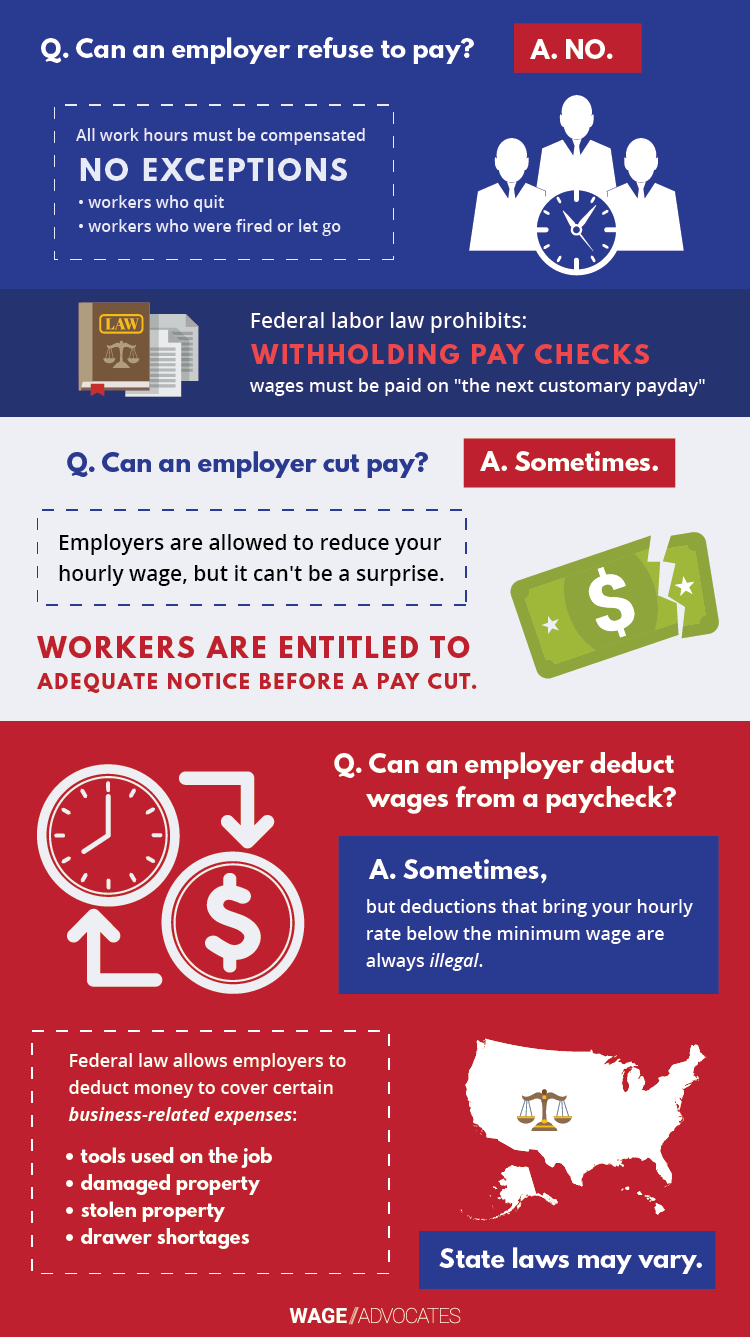

There is no exception to this law that allows an employer to delay payment or deduct from pay until the next payday. Your employer cannot require you to work more than 40 hours in a week and then refuse to pay you time and a half for any time you worked over 40 hours assuming youre nonexempt. It is important for employees to understand.

They have every right to set a schedule that sees you working over 40 hours but only so long as they properly pay you for the overtime hours you work. Neglecting to pay employees the proper compensation for all hours worked including overtime is not the only way employers can deprive workers of their proper compensation. In other words they cant delay payment of wages to a subsequent pay period.

Some employees are exempt from receiving overtime pay. Overtime that youre contractually obligated to offer and employees must accept. It should be noted that these claims can potentially result in compensation figures of up to 25000 if it is found that there was a breach.

For example all employees and workers are entitled to 56 weeks paid statutory leave and statutory sick pay if they qualify. Punitive responses such as wage reduction fines or delayed pay. This rule applies even to the United States government as it discovered when it attempted to delay paying wages in light of a government shutdown.

However even though an employer classifies someone as an independent. However your average pay for the total hours you work must not fall below the National Minimum Wage. The FLSA states that employers must pay their employees promptly for all the hours those employees have worked.

In another example if an employer cuts payments to a salaried exempt employee the DOLs regulations may mean the employee is no longer exempt and the employee must be paid at least minimum wage. It isnt uncommon for employees to work overtime at least once in their career. An employer having cash flow problems and is worried about meeting payroll must pay non-exempt hourly employees their full wage and any overtime due on their regularly scheduled payday.

Employers do not have to pay workers for overtime. In practice many businesses have policies that state that if no timesheet is submitted by the payroll cut-off time then the pay for that person will be withheld until the timesheet is submitted. Thus if you have been denied payment for overtime hours worked or an employer is withholding your overtime pay it is in your best interests to consult with a well qualified and knowledgeable employment attorney in your area.

Find out whether it is legal for employers to refuse to pay their employees overtime penalty rates. Reasons for salary not being paid on time Delays in payment can come about for various reasons. Businesses then either run an out-of-cycle pay for that person or hold over the pay until the following pay.

Overtime Pay May Not Be Waived. In fact according to new statistics revealed by Hays overtime increased in 32 per cent of organisations over. An employer who is found to have violated this rule may be ordered to pay penalties in the full amount of wages that were paid late plus the attorneys fees for both parties lawyers.

One of the categories of exempt individuals is independent contractors. Can Employers Refuse Their Employees Overtime Payments. Where an employee has been suspended he will be entitled to be paid full pay.

A common tactic employers use to withhold an employees earning is to refuse to issue reimbursement for expenses paid by employees to fulfill required duties. Your employment contract will usually. The employee is then due additional overtime computed by multiplying the 5 overtime hours by one-half the regular rate of pay 450 x 5 2250.

Ultimately though it is the employers responsibility under federal and state law to pay employees on the established payday for hours that were worked regardless of whether or not a complete timesheet was submitted. Employers may lawfully withhold wages in the following circumstances. Overtime can either be.

Some employees fall into one of several overtime exemptions however. Employees have the right to sue their employers if they feel there has been a breach in their employment contract. Employers must pay all wages due each pay period.

A lawyer would need more information about how your are paid and your job duties to determine whether you a exempt from overtime. This is where youre under no obligation to offer employees overtime and theyre under no obligation to accept it when offered. If mistakes are made during the payroll process that will mean pay is to be delayed.

Most employees are entitled to overtime pay for all hours over 40 in a work week.

Salary Certificate Sample Is Prepared By Human Resource Department Of An Organizations In Ord Certificate Format Certificate Templates Business Letter Template

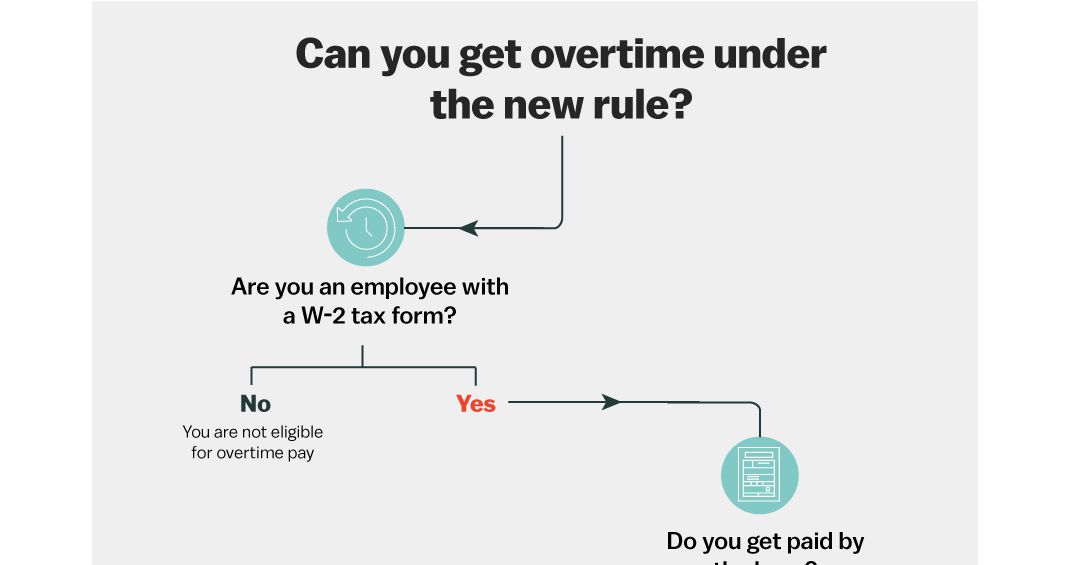

Overtime Rule The Department Of Labor Just Expanded Overtime Pay Vox

Flsa Overtime Rule Changes Overview Compliance Strategies Business Risk Social Media Infographic Risk Management

New Cover Letter For Therapist Job You Can Download For Full Letter Resume Template Here Http Ww Cover Letter For Resume Cover Letter Cover Letter Template

Can I Sue My Employer For Not Paying Me Wage Violations

Late Payment Mcgillivary Steele Elkin

Pin By So El On Past Exam Papers Safety Management System Past Exam Papers Occupational Health And Safety

Can My Employer Force Me To Work Overtime Can I Refuse

Professional Compensation Plan Template Elegant Professional Pensation Plan Template Updrill In 2021 How To Plan Business Budget Template Free Word Document

/cdn.vox-cdn.com/uploads/chorus_asset/file/19228949/flow_chart_board_2.jpg)

Overtime Rule The Department Of Labor Just Expanded Overtime Pay Vox

Some Salaried Employees Are Entitled To Overtime Pay Are You One Of Them Kreis Enderle

![]()

When Should Overtime Be Paid Gibbons Law Group Pllc

Personal Injury Lawyer Brooklyn Personal Injury Lawyer Injury Lawyer Personal Injury Attorney

California Overtime Law Everything You Need To Know Crosner Legal

California Overtime Laws Calculating Overtime Pay In California California Chamber Of Commerce

/cdn.vox-cdn.com/uploads/chorus_asset/file/19228949/flow_chart_board_2.jpg)

Overtime Rule The Department Of Labor Just Expanded Overtime Pay Vox

/cdn.vox-cdn.com/uploads/chorus_asset/file/19228949/flow_chart_board_2.jpg)

Overtime Rule The Department Of Labor Just Expanded Overtime Pay Vox

Procasinators Infographic Infographic Marketing Management Infographic

Government Of The Punjab School Education Department Has Issued The Official Notification Letter On 3 October 2019 In Conn Education Progress Report Pensions

Post a Comment for "Can An Employer Delay Overtime Pay"